Mastering Drift Protocol v24.12.3: Your Ultimate Guide to Decentralized Trading

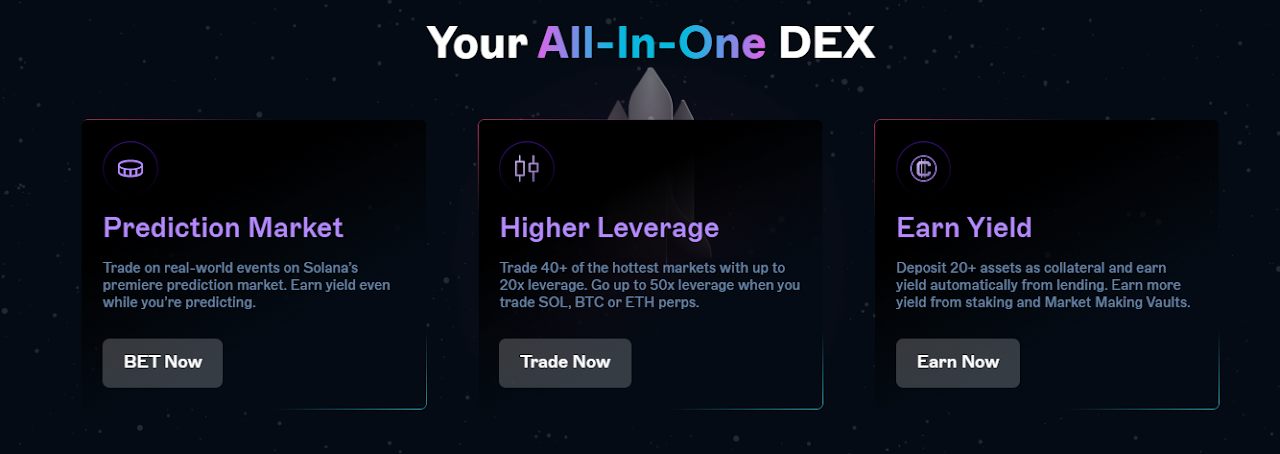

Decentralized Finance (DeFi) on Solana continues to evolve at a breakneck pace, and leading the charge is Drift Protocol. As the largest open-source perpetual futures exchange on Solana, Drift provides a trading experience that blends the speed and advanced features of centralized exchanges (CEXs) with the transparency and security of self-custody that DeFi users demand. The latest iteration, v24.12.3, refines the platform, offering a more robust and capital-efficient environment for trading, lending, and earning.

This guide, in the practical EEat format (Experience, Expertise, Authority, Trust), will walk you through the essential steps to navigate and maximize your use of Drift Protocol v24.12.3.

Experience: Setting Up Your Decentralized Trading Hub

Your journey on Drift begins with a few simple setup steps that emphasize security and self-custody.

1. Wallet Connection and Funding

Drift Protocol is built on Solana, meaning you'll need a compatible non-custodial wallet like Phantom or Solflare.

- Connect: Navigate to the Drift Protocol interface and connect your Solana wallet. Since Drift is non-custodial, your assets remain in your control at all times.

- Fund: Deposit collateral into your Drift account. Drift is highly capital-efficient, supporting the deposit of over 20 different assets (like USDC) as collateral. This collateral can not only back your leveraged positions but can also automatically earn yield through the protocol's lending markets.

2. Understanding the Cross-Margin System

Drift operates on a cross-margined risk engine. This means all assets deposited into your account act as unified collateral for all your positions across perpetual futures and spot trading. This is a significant advantage, as it maximizes capital efficiency compared to having segregated margin accounts for each trade.

Expertise: Trading and Leveraging the Core Features

Drift offers a comprehensive suite of products, but its flagship is Perpetual Futures.

3. Trading Perpetual Futures

Perpetual Futures (Perps) allow you to trade with leverage on the price movements of major cryptocurrencies (like SOL, BTC, and ETH) without an expiration date. Drift offers up to 10x leverage on most pairs and even higher on key markets for experienced traders (up to 101x in specific modes).

- Select Market: Choose your desired perpetual contract (e.g., SOL-PERP).

- Order Type: Drift supports both Market Orders (executed instantly at the current best price) and Limit Orders (resting orders placed on the Decentralized Limit Order Book or DLOB). As a beginner, starting with market orders is simpler, while limit orders allow for more precise entry/exit points.

- Set Position and Leverage: Enter the size of the underlying asset you wish to trade or the amount of collateral you want to commit. The platform will clearly display the calculated leverage and, crucially, your liquidation price. Always monitor this to manage your risk.

- Execute: Confirm the transaction via your connected wallet.

4. The Hybrid Liquidity Model

A key technical feature of v24.12.3 is its hybrid liquidity mechanism, which ensures deep liquidity and minimal slippage:

- Just-in-Time (JIT) Liquidity: Market orders are routed through a short auction, where market makers compete to fill the order at the best possible price.

- Decentralized Limit Order Book (DLOB): Provides resting liquidity via limit orders, managed by a network of Keeper Bots.

- Automated Market Maker (AMM): Acts as a backstop liquidity provider, ensuring constant liquidity.

Authority and Trust: Earning Yield and Managing Risk

Drift isn't just for high-leverage trading; it's a complete DeFi ecosystem.

5. Passive Earning Opportunities

You can actively earn yield on your deposited assets, boosting your overall capital returns:

- Lend/Borrow: Simply depositing assets makes them available for borrowing, automatically earning a variable rate yield.

- Insurance Fund Staking: Users can stake assets into the protocol's Insurance Fund, which helps cover shortfalls during extreme liquidations. In return, stakers earn yield from a portion of exchange fees.

- Vaults: For sophisticated users, Market Maker Vaults and Backstop AMM Liquidity (BAL) allow for leveraged liquidity provision, offering higher, but more complex, yield opportunities.

6. Risk Management and Security

Drift Protocol places a high priority on security, which builds trust for its users:

- Decentralization: All deposits, withdrawals, and trades are executed transparently on-chain.

- Advanced Risk Engine: The system uses partial liquidations—gradually unwinding positions when margin is breached—instead of abrupt, full liquidations. This minimizes market impact and protects users from the excessive risks common on some platforms.

- Audits: The open-source smart contracts are regularly audited by leading security firms, reinforcing the platform's reliability.

Drift Protocol's commitment to self-custody, combined with its high-speed, capital-efficient architecture, positions it as a premier destination for decentralized derivatives trading. Dive in, start small, and explore the future of finance on Solana.